Angioplasty is a common medical procedure used to treat blocked or narrowed arteries, often caused by conditions like coronary artery disease. In India, many patients wonder if their health insurance covers the cost of this life-saving treatment. Understanding the scope of insurance coverage for angioplasty is crucial for financial planning and peace of mind during medical emergencies.

Medical disclaimer: This content is for general awareness and does not replace a doctor’s consultation. For diagnosis or treatment decisions, consult a qualified specialist.

With rising healthcare costs, knowing whether your insurance policy includes angioplasty can help you avoid unexpected expenses. This article explores the details of insurance coverage, top plans, and how to claim benefits for angioplasty in India. Stay informed to ensure you receive the best possible care without financial stress.

Does Health Insurance in India Cover Angioplasty?

Yes, most health insurance policies in India cover angioplasty as part of their hospitalization benefits. Angioplasty is classified as a medically necessary procedure for treating blocked arteries, which makes it eligible for coverage under many plans. However, the extent of coverage depends on the specific terms of your policy.

Typically, insurance covers expenses such as hospitalization costs, doctor’s fees, and the cost of stents used during the procedure. Some policies may also include pre- and post-hospitalization expenses. It is essential to review your policy documents or consult your insurer to understand the exact coverage details.

Patients should also be aware of waiting periods, sub-limits, and exclusions that might apply. For instance, some policies may not cover angioplasty if it is related to a pre-existing condition unless the waiting period has been completed. Always verify these details to avoid surprises during a medical emergency.

Top Insurance Plans for Angioplasty in India

Several insurance providers in India offer plans that include coverage for angioplasty. Some of the top options include policies from companies like Star Health, ICICI Lombard, and HDFC ERGO. These plans are designed to cover critical illnesses, including heart-related treatments.

Here are some features to look for in a good insurance plan for angioplasty:

- Comprehensive coverage for hospitalization and treatment costs.

- Inclusion of pre- and post-hospitalization expenses.

- Coverage for multiple stents, if required.

- Reasonable waiting periods for pre-existing conditions.

It is advisable to compare different plans based on their premiums, coverage limits, and exclusions. Consulting with an insurance advisor can also help you choose the best policy for your needs.

How to Claim Insurance for Angioplasty Treatment

Claiming insurance for angioplasty involves a straightforward process, but it requires proper documentation and adherence to your insurer’s guidelines. The first step is to inform your insurance provider about the planned or emergency procedure as soon as possible.

Depending on your policy, you can opt for either a cashless claim or reimbursement. For cashless claims, ensure that the hospital is part of your insurer’s network. Submit your health card and other required documents at the hospital’s insurance desk. The insurer will directly settle the bills with the hospital.

For reimbursement claims, you need to pay the bills upfront and then submit the necessary documents, including hospital bills, discharge summary, and doctor’s prescriptions, to the insurer. Ensure all documents are complete to avoid delays in claim processing.

Angioplasty Costs in India: What Insurance Covers

The cost of angioplasty in India can range from ₹1.5 lakh to ₹3.5 lakh, depending on factors like the hospital, type of stent used, and the patient’s condition. Fortunately, most health insurance policies cover a significant portion of these expenses.

Here’s a breakdown of what insurance typically covers:

| Expense Type |

Coverage |

| Hospitalization |

Fully or partially covered |

| Stent Costs |

Covered up to policy limits |

| Pre- and Post-Hospitalization |

Covered for a specific duration |

| Doctor’s Fees |

Included in most policies |

However, some policies may have sub-limits on stent costs or exclude certain types of stents. Always check your policy details to understand the exact coverage and out-of-pocket expenses.

Pre-Existing Conditions and Angioplasty Insurance Coverage

Pre-existing conditions like diabetes or hypertension can significantly impact your insurance coverage for angioplasty. Most insurance policies in India impose a waiting period, typically ranging from 2 to 4 years, before covering treatments related to pre-existing conditions.

If you have a pre-existing condition, it is crucial to disclose it while purchasing the policy. Failure to do so can result in claim rejection. Some insurers also offer specialized plans for individuals with pre-existing conditions, which may have shorter waiting periods or higher premiums.

To ensure smooth claim processing, maintain all medical records and communicate openly with your insurer. Understanding the terms of your policy can help you plan better and avoid financial stress during emergencies.

Cashless Hospitalization for Angioplasty: How It Works

Cashless hospitalization is a significant benefit offered by many health insurance providers in India, especially for critical procedures like angioplasty. Under this system, the insurance company directly settles the hospital bills, reducing the financial burden on patients. To avail of this benefit, the hospital must be part of the insurer's network hospitals.

Before undergoing angioplasty, it is crucial to inform your insurer and get pre-authorization. This process involves submitting your medical reports and doctor's recommendations to the insurance provider. Once approved, the hospital and insurer coordinate the payment process.

Patients should ensure they understand the terms of their policy, as some expenses like consumables or non-medical items may not be covered. Always check the list of network hospitals and confirm the availability of cashless services for cardiac procedures.

Waiting Periods for Angioplasty Coverage in India

Most health insurance policies in India come with a waiting period before they cover specific treatments like angioplasty. This waiting period can vary depending on the insurer and the type of policy. Typically, the waiting period for pre-existing conditions ranges from 2 to 4 years.

For new policyholders, there is often an initial waiting period of 30 days during which no claims are entertained except for emergencies. If you have a history of heart disease, the waiting period for angioplasty coverage might be longer. It is essential to read the policy document carefully to understand these terms.

Some insurers offer policies with reduced waiting periods for critical illnesses, but these may come with higher premiums. Always compare policies and choose one that aligns with your medical history and financial needs.

Documents Needed to Claim Angioplasty Insurance

Filing a claim for angioplasty coverage requires submitting specific documents to your insurer. These documents help verify your eligibility and ensure a smooth claims process. Here is a list of commonly required documents:

- Policy document and insurance card

- Doctor's prescription and treatment recommendation

- Hospital bills and payment receipts

- Diagnostic reports, including angiography results

- Discharge summary from the hospital

Ensure all documents are complete and accurate to avoid claim rejection. Some insurers also require pre-authorization forms for cashless claims. Keep copies of all documents for your records and submit them within the stipulated time frame.

Best Health Insurance Policies for Heart Procedures

Choosing the right health insurance policy for heart procedures like angioplasty is crucial. Many insurers in India offer specialized plans that cater to cardiac care. These policies often include coverage for pre- and post-hospitalization expenses, diagnostic tests, and even rehabilitation.

Some of the top health insurance providers for heart procedures include:

- Star Health Cardiac Care Insurance

- ICICI Lombard Complete Health Insurance

- Max Bupa Heartbeat Health Insurance

- HDFC ERGO Critical Illness Insurance

When selecting a policy, consider factors like the sum insured, waiting periods, and network hospitals. Policies with higher coverage limits and shorter waiting periods are ideal for those with a history of cardiovascular diseases.

Does Your Insurance Cover Post-Angioplasty Expenses?

Post-angioplasty care is an essential part of recovery and often involves follow-up consultations, medications, and lifestyle changes. Many health insurance policies in India cover post-hospitalization expenses, but the extent of coverage varies.

Typically, insurers provide coverage for expenses incurred within 60 to 90 days after discharge. This includes costs for diagnostic tests, prescribed medications, and follow-up visits. However, not all policies cover rehabilitation or long-term care, so it is important to check the terms and conditions.

If your policy does not cover post-angioplasty expenses, consider purchasing a top-up plan or a critical illness rider. These add-ons can provide additional financial support for ongoing treatment and recovery.

Critical Illness Insurance vs. Regular Health Insurance

When considering insurance for medical procedures like angioplasty, it’s essential to understand the difference between critical illness insurance and regular health insurance. Critical illness insurance provides a lump sum payout upon diagnosis of specific conditions, including heart diseases.

On the other hand, regular health insurance covers hospitalization costs, including procedures like angioplasty, up to the sum insured. While critical illness insurance is beneficial for long-term financial support, regular health insurance is crucial for covering immediate treatment expenses.

For patients undergoing angioplasty, combining both types of insurance can offer comprehensive financial protection. Always check the policy terms to ensure coverage for cardiac treatments and related expenses.

Understanding Sub-Limits for Angioplasty in Insurance

Many health insurance policies in India include sub-limits for specific treatments like angioplasty. A sub-limit is a cap on the amount the insurer will pay for a particular procedure, even if the total sum insured is higher.

For example, a policy with a sum insured of ₹5 lakhs may have a sub-limit of ₹2 lakhs for angioplasty. This means the insurer will only cover up to ₹2 lakhs for the procedure, and the remaining cost must be borne by the patient.

It’s crucial to read the policy document carefully and understand these sub-limits. Some insurers offer policies with no sub-limits, which can be beneficial for cardiac patients. Always compare policies to find one that best suits your medical needs.

Steps to Check Angioplasty Coverage in Your Policy

Before undergoing angioplasty, it’s important to verify whether your health insurance policy covers the procedure. Follow these steps to ensure clarity:

- Review your policy document for specific mentions of angioplasty coverage.

- Check for any sub-limits or co-payment clauses related to cardiac treatments.

- Contact your insurer or agent to confirm the coverage details and pre-authorization requirements.

- Ensure that the hospital where you plan to undergo the procedure is part of the insurer’s network hospitals.

- Submit all necessary documents, such as medical reports and doctor’s recommendations, for claim approval.

Being proactive can help avoid claim rejections and ensure a smooth treatment process.

Tax Benefits of Health Insurance for Angioplasty

Health insurance not only provides financial protection but also offers tax benefits under Section 80D of the Income Tax Act in India. Premiums paid for health insurance policies are eligible for tax deductions, reducing your overall taxable income.

For individuals below 60 years, the maximum deduction is ₹25,000 per year, while senior citizens can claim up to ₹50,000. If you are paying premiums for your parents, you can claim an additional deduction of ₹25,000 or ₹50,000, depending on their age.

These tax benefits make health insurance an attractive option for managing the high costs of procedures like angioplasty. Always retain premium receipts and policy documents for tax filing purposes.

Tips to Choose the Right Insurance for Angioplasty

Choosing the right health insurance for angioplasty requires careful consideration. Here are some tips to help you make an informed decision:

- Opt for a policy with a high sum insured to cover expensive cardiac treatments.

- Check for policies with no sub-limits or co-payment clauses for angioplasty.

- Ensure the policy includes coverage for pre- and post-hospitalization expenses.

- Look for insurers offering cashless treatment at network hospitals.

- Consider add-ons like critical illness riders for enhanced coverage.

By evaluating these factors, you can select a policy that provides comprehensive coverage and peace of mind during medical emergencies.

Best Coronary Angioplasty Doctors in India

Two highly reputed doctors specializing in Angioplasty in India are Dr. Naresh Trehan, Chairman and Managing Director of Medanta - The Medicity, Gurugram, with over 40 years of experience and international recognition in cardiac surgery, and Dr. Ashok Seth, Chairman of Fortis Escorts Heart Institute, New Delhi, with over 35 years of expertise in interventional cardiology and numerous global accolades.

Learn more on best coronary angioplasty doctors in india

Best Coronary Angioplasty Hospitals in India

Two leading hospitals offering advanced Angioplasty in India are Fortis Escorts Heart Institute, New Delhi, known for its NABH accreditation and cutting-edge cardiac care, and Medanta - The Medicity, Gurugram, a JCI-accredited facility renowned for multidisciplinary care and robotic-assisted procedures. Both hospitals provide comprehensive international patient services and have a track record of successful outcomes.

Find more best coronary angioplasty hospitals in india

Coronary Angioplasty Cost in India

The cost of Angioplasty in India typically ranges from INR 1,50,000 to INR 3,50,000 (approximately USD 1,800 to USD 4,200). Factors influencing costs include the doctor’s expertise, hospital type, and procedure complexity. The average hospital stay is 2-3 days. India offers a significant cost advantage compared to Western countries, with options for medical insurance and third-party financing.

Learn coronary angioplasty cost in india

Coronary Angioplasty Treatment in India

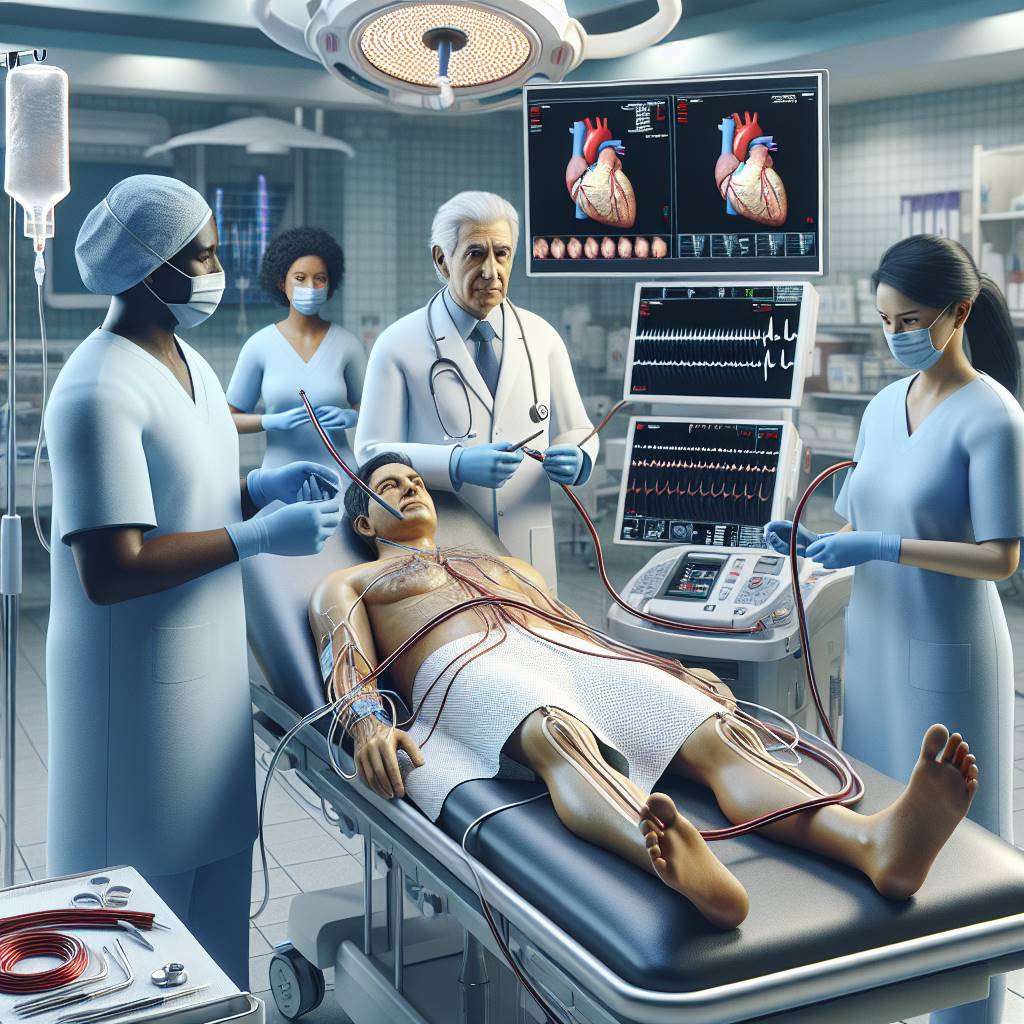

Angioplasty in India involves inserting a catheter with a balloon to open blocked arteries, often followed by stent placement. Advanced technologies like drug-eluting stents and intravascular imaging are widely used. Recovery typically takes 1-2 weeks. Top hospitals adhere to global medical protocols and adopt innovations like robotic-assisted angioplasty for precision and safety.

Learn on Coronary Angioplasty Treatment in India

FAQs

Is angioplasty covered under health insurance in India?

Yes, most health insurance policies in India cover angioplasty, including the cost of the procedure, hospital stay, and related expenses. However, coverage specifics depend on the policy terms and conditions.

What is the recovery time after angioplasty?

Recovery after angioplasty typically takes 1-2 weeks. Patients are advised to follow their doctor’s recommendations regarding medications, lifestyle changes, and follow-up visits.

Are there any risks associated with angioplasty?

While angioplasty is generally safe, potential risks include bleeding, infection, or artery re-narrowing. Choosing an experienced doctor and accredited hospital minimizes these risks.

What is the success rate of angioplasty in India?

The success rate of angioplasty in India is over 95% in uncomplicated cases, thanks to advanced technology and skilled cardiologists.

Can international patients avail of angioplasty in India?

Yes, India is a popular destination for international patients seeking angioplasty, offering high-quality care at affordable costs with dedicated international patient services.

How long does the angioplasty procedure take?

The angioplasty procedure typically takes 1-2 hours, depending on the complexity of the blockage and the number of arteries treated.

What lifestyle changes are recommended after angioplasty?

After angioplasty, patients are advised to adopt a heart-healthy diet, exercise regularly, quit smoking, and manage stress to prevent further complications.

Is angioplasty a permanent solution for blocked arteries?

While angioplasty effectively opens blocked arteries, it is not a permanent solution. Lifestyle changes and medications are essential to prevent re-narrowing.

What is the cost of angioplasty in India for international patients?

The cost of angioplasty for international patients in India ranges from USD 1,800 to USD 4,200, depending on the hospital and procedure complexity.

Are there alternative treatments to angioplasty?

Alternatives to angioplasty include medications, lifestyle changes, and in some cases, coronary artery bypass grafting (CABG). The choice depends on the severity of the condition.

Understanding Angioplasty: Treatment Options and Considerations

Angioplasty is a common procedure used to treat narrowed or blocked coronary arteries, helping to restore blood flow to the heart. For patients considering this treatment in India, understanding the medical visa process is crucial. Our comprehensive Medical Visa Guide for Angioplasty Treatment in India provides essential information on obtaining the necessary documentation and navigating the healthcare system effectively.

While angioplasty can significantly improve heart health, many patients wonder about its long-term effectiveness. A key question arises: Is Coronary Angioplasty a Permanent Cure? This insightful article explores the potential for recurrence of blockages and the importance of lifestyle changes post-procedure to maintain heart health.

In conclusion, understanding both the logistical aspects of traveling for treatment and the long-term implications of angioplasty is vital for patients seeking optimal heart health solutions.

Explore the Best Heart Care Resources in India

Find some of the top cardiologist, surgeons and the best heart hospitals in India

Best Heart Hospitals in India

Choosing the right hospital is crucial for successful heart treatments. If you want to explore trusted options, check the list of Best Heart Hospitals in India offering world-class facilities, advanced cardiac care units, and experienced teams for both simple and complex procedures.

Best Cardiologists in India

Finding the right cardiologist can make a huge difference in early diagnosis and long-term heart health. If you are looking for the Best Cardiologists in India, see this curated list of experts who specialize in preventive care, interventional cardiology, and complex heart disease management. Check the full list Best Cardiologists in India.

Best Cardiac Surgeons in India

If you are planning for heart surgery and need top-level expertise, we recommend exploring the Best Cardiac Surgeons in India. These surgeons have a proven record in performing bypass surgeries, valve replacements, and minimally invasive heart operations with excellent outcomes.

Get more indepth information on Cardiology treatments and their costs.

Conclusion

Your cardiology health deserve the best care. Explore the links above to learn more about the top cardiac hospitals and cardiac surgeons in India.

Cardiac rehabilitation is a medically supervised program designed to improve cardiovascular health after angioplasty. It typically includes exercise training, education on heart-healthy living, and counseling to reduce stress. The goal is to help patients recover, improve their fitness and confidence, and make necessary lifestyle changes to reduce the risk of future heart issues. This comprehensive approach supports physical, emotional, and psychological well-being, enhancing the overall quality of life for heart patients. The Role of Cardiac Rehabilitation After Angioplasty

Angioplasty often employs various stents to keep arteries open after clearing blockages. Bare-metal stents (BMS) provide permanent support but can lead to scar tissue. Drug-eluting stents (DES) release medication to prevent blockages and are suited for complex cases. Bioabsorbable stents dissolve over time and are ideal for younger patients. The choice depends on the blockage severity, patient’s age, and medical history. Understanding the Different Types of Stents Used in Angioplasty

Coronary angioplasty, while generally safe, carries certain risks and potential complications. These can include re-narrowing of the artery, blood clots, injury to the heart arteries, infection, bleeding, and allergic reactions to the dye used during the procedure. Understanding these risks is crucial for patients to make informed decisions and take necessary precautions. Risks and Complications of Coronary Angioplasty